The August 30th, 2023 Presentation outlined that the Legislators sitting on the Advisory Committee were Advisory Only and not in a capacity to rejected any Project and that the Agencies were in charge of the Driving.

” If a Project were deemed attractive and the Price Tag was Higher than $50 Million, the Advisory Committee could ask the State Finance Council to authorize monies like an Advance against future monies going to Build Kansas.” according to Calvin Reed, Secretary of Transportation & Coordinator of the HUB Sub Cabinet

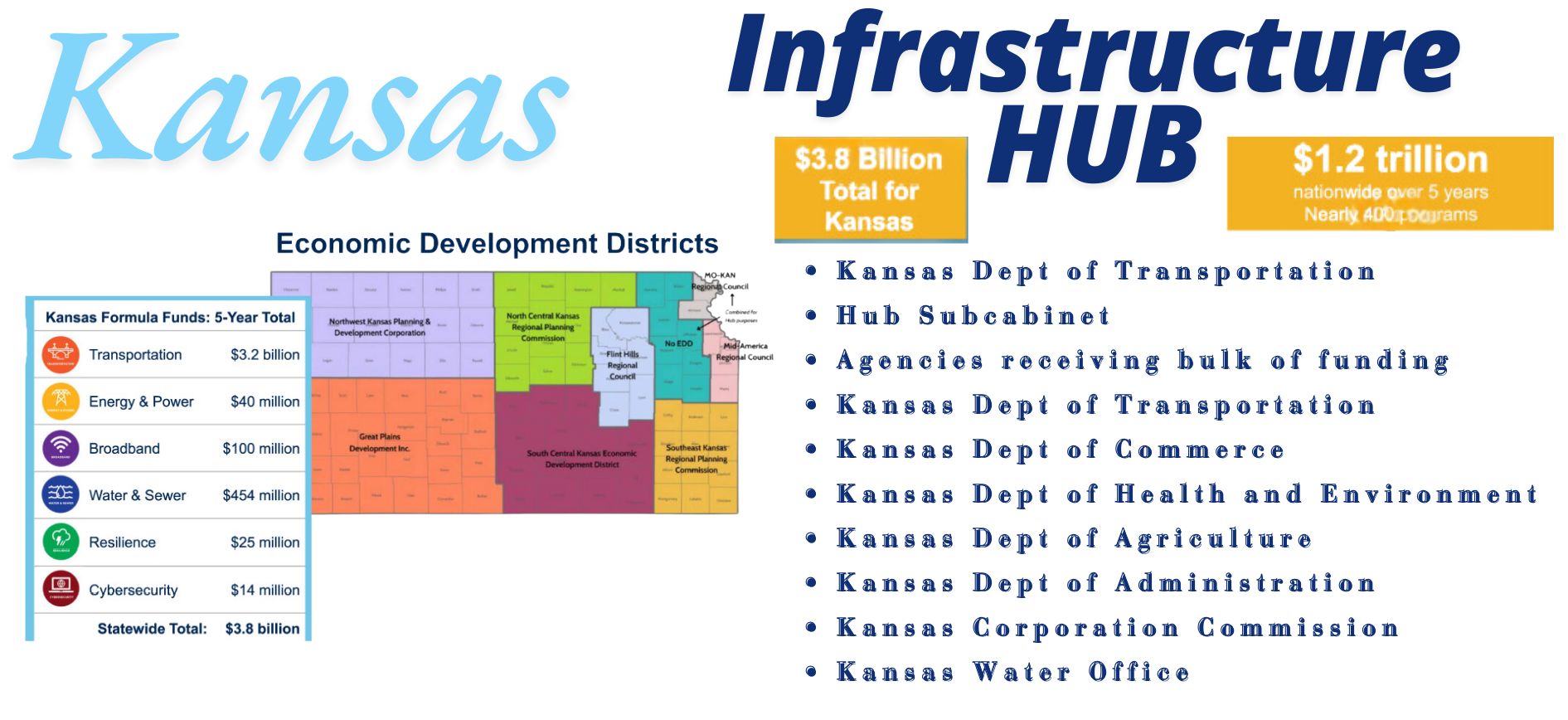

Uniquely, the State is divided into Regions by the Dept. of Commerce Economic Development Project Managers and works closely with the Associations of Counties, County Economic Developers, County Managers, as a Steering Committee, identifying projects needed by the community. Elected Legislators on the Advisory Council are:

- Senator Ty Masterson, Vice Chair, Senate President Appointee

- Senator JR Claeys, Senate President Appointee

- Senator Usha Reddi, Senate Minority Leader Appointee

- Senator Tim Shallenburger, Senate President Appointee

- Representative Shannon Francis, Speaker of the House Appointee

- Representative Henry Helgerson, House Minority Leader Appointee

- Representative Kyle Hoffman, Speaker of the House Appointee

- Representative Lindsay Vaughn, Governor Appointee

The irony of a using Taxpayers money from the State General Fund is for over two years Kansas Property Owners have battled the expansion of Industrial Solar, Wind, Battery, and Transmission on the Local County Front, in Capital hearing Rooms, and County Commission Meetings, pushing back against the aggressive Energy Companies that have the ability to use eminent domain. Taxpayers will likely balk at the idea that tax money collected from the ever increasing property taxes would be considered as Economic Development. Flooding local economies with projects poised to enhance “Land Grabbing” by Government will be met with resistance.

Transparency of Federal Funds coming through a Back Door and no Accountability in sight, the last question the Advisory Council should ask should be why the use of the states professional staff who write Legislation and Revise Statutes. Is it by design or is that needed to skirt the hurdles that need cleared?

Click Here to view organizations like MARC, Projects funding Private Rail, and the recent interest in State Water Discussions:

Staff receives $5 Million in Funding to Administer:

- Nancy Fontaine, Committee Assistant

- Chardae Caine, Legislative Research

- Dylan Dear, Legislative Research

- Chris Waggoner, Office of Revisor of Statutes

- Jill Wolters, Office of Revisor of Statutes

Virginia Macha – Resident of Allen County, KS

Stay Informed, Sign-up for the Stand 4 the Land Kansas Newsletter