Appraisal Values Just Don’t Add Up

For two years, Kansas Property Owners have tried to make sense of property tax statements that reflect increased values in property that are driving tax bills into the danger zone for many Kansas Families. Who Determines that increased value resembles a game of Ping Pong between County Assessors, County Commissioners, Members of the Kansas Legislature, and the Kansas Department of Revenue Property Assessment Value Director David Harper. Who and Why isn’t the only things murky about answers given to property owners that protest the values, it becomes even muddier when examining the changes to the appraisal process that has been the best-kept secret of the Kelly Administration.

The Big Lie: Fair vs Equitable

The NEW SYSTEM is riddled with changes in statutes. Here is the Short Version: How Kansas became the state that is taxing property owners off their land in the name of EQUITY. The cast of perpetrators include Governor Laura Kelly’s adopted Justice 40 Initiative from the Biden Green New Deal, Kansas Department of Revenue Property Assessment Value Director David Harper, a software company instrumental in building a Cloud base data systems with AI capabilities named Tyler Technology Inc., grant funder Kansas Information Network (INK) Board, the Kansas Department of Revenue’s Data collecting Tool called KANPAY, and a host of legislative bills that codified this into law by the Kansas Legislature.

Is The NEW Appraisal System Redistributing Wealth?

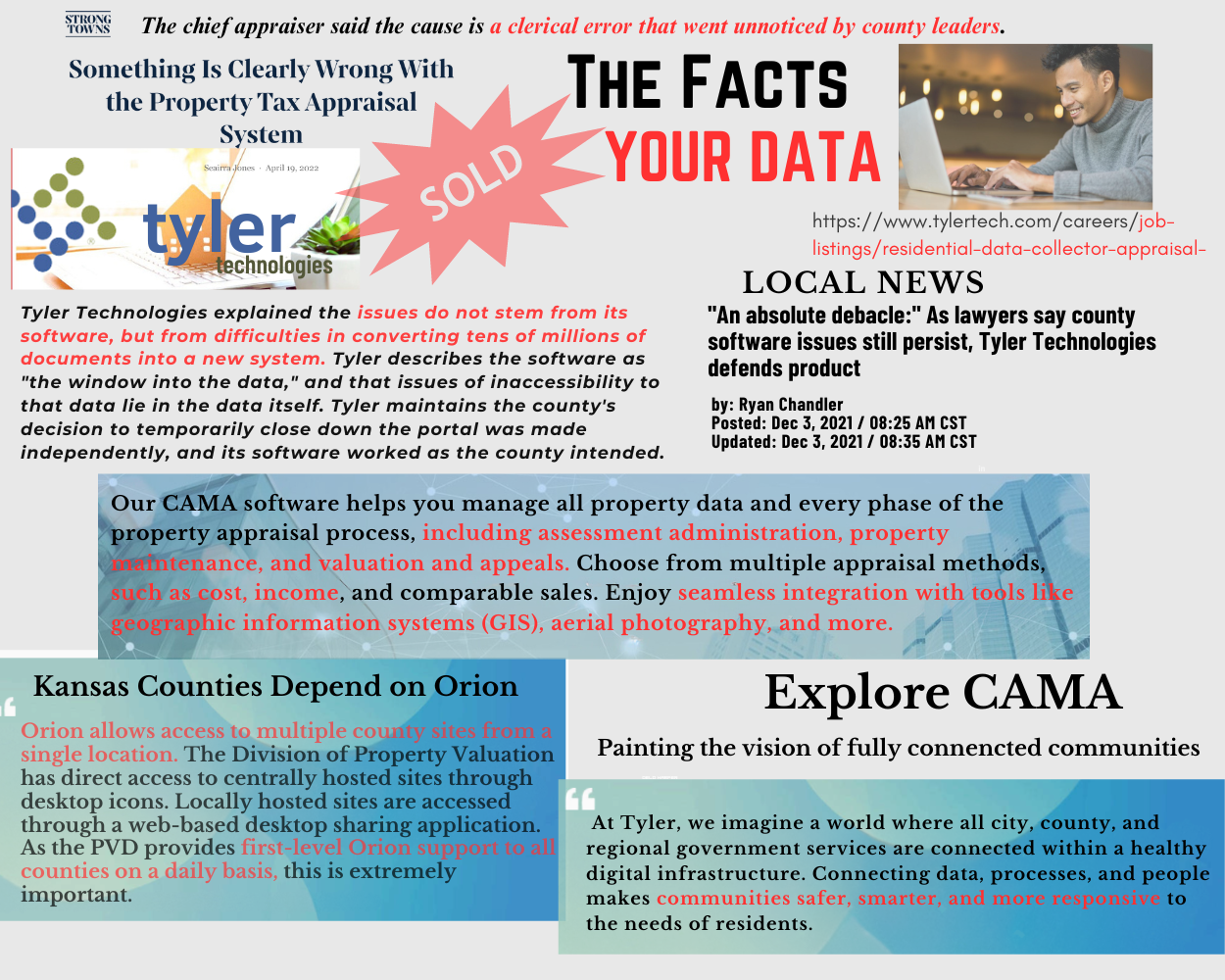

This Mass Appraisal values generated by Computer Software by Tyler Technology comes with a host of critics and legal challenges. See Below With the collusion of government bodies with this kind of weaponry, will be the largest transfer of private wealth to government coiffures in Kansas history. Sooner or later the burden becomes to heavy a load and history will not be forgiving to those that have accomplished this redistribution of wealth in the name of EQUITY. In 2022 alone, this project generated $5 Billion of New Tax Dollars and removed those dollars from local economies that were already hurting from Inflation and Lock Downs. ISN’T it time for a Constitutional Amendment for Taxpayers to Vote ON? Make the Call Today Bring The Legislature Back To Work!

Selling Personal Data For Profit, No Disclosure |

Property Tax or a Social Justice Taxing System

What does the Appraisal System Looks Like Now? KDOR has a weapon: “Orion CAMA (Computer-assisted Mass Appraisal System)”, a powerful cloud-based system designed to increase the information collected on Kansans through grants. The grant funding for the project is based on information or deliverables on amounts of data that will create an E-Government system that can connect the 105 County governments. This funding is approved by Kansas INK and that data will drive programs like Assessment Connect designed by Tyler Technology Inc. “Assessment Connect” will generates profiles for tax purposes and determine market values of Kansan’s property.

What Tax Will Be Next: ESG?

This capability would make the GIS-ORION CAMA system capable of reappraising property in real-time not annually. This sophisticated database will be providing access to your information by other agencies. Of course there will be a cost for access to taxpayers data that will generate for NEW service projects, initiatives, and Special Programs to increase tax revenue all in the name of Equity. According to this statement on Tyler Technology’s Website by KDOR’s director of Property and Valuation says it all when it comes to your property:

“The 1.7 Million parcels of land, water, minerals, and resources are captured in a “data pipeline” with the help of 91 Kansas Counties to share and make the data available to all professional service companies that would be needed to build all the API’s, the subscription fee would be in the range of $550,000-$600,000 annually” stated David Harper. The List of Statute changes required for the New Appraisal System can be viewed in a report presented to the Kansas Legislative LEADERSHIP on Nov. 18 2022 and In the Report prepared by KDOR included Statutes that would have to be changed. Read More HERE: In two short years property owners in Kansas find themselves at the mercy of BIG GOVERNMENT having their data information and property exposed publicly.

The “LAND GRAB” Is The New Gold Rush

Landowners have already experienced the “Land Grab” from their information in the Hands of Associations that represent Land Acquisition. Investors locating such things as Solar Utility search the data pipeline to identify properties that are under water. Locating a property with back taxes, or properties placed in the 52 COUNTY LANDBANKS, or looking for leasing land from out of state owners has become effortless. Game On for TARGETING Taxpayers! Isn’t it Time For some Honesty and Transparency in Topeka! ISN’T it time for a Constitutional Amendment that allows Taxpayers a Voice, a Vote? Are you ready to take a STAND?

Make the Call or Sign the PETITION Today

Bring The Legislature Back To Work!

- Make the Call Today! It is time for Leadership House & Senate Come To Topeka To Fix The Tax Problem

-

Make the Call Today! Call Your County Commissioner STOP KDOR Over Reach of local government

-

Make the Call Today! Call Attorney General Kobach Investigate Collecting & Selling of Personal Data by KDOR

When Property Tax Decisions Were Local Decisions

Prior to all this chaos, the Kansas Appraisal and Property Tax Procedures adopted by Counties to keep Property Tax in line with county budgets was always directed by the County Appraiser’s office. Appraisals were conducted on around 17% of the property parcels in the county each year. Those 17% of parcels were then evaluated for changes to the Property due to construction, improvements, land use, and sales comparatives and then recorded in the CAMA Mapping System to keep property information current. In short, appraisal changes on any property were updated every six years. Property owners with no intention of ever selling were reviewed every six years. Fair or Not, property owners could find their way to the County Appraiser’s Office and get an answer to appraisal changes that made sense.