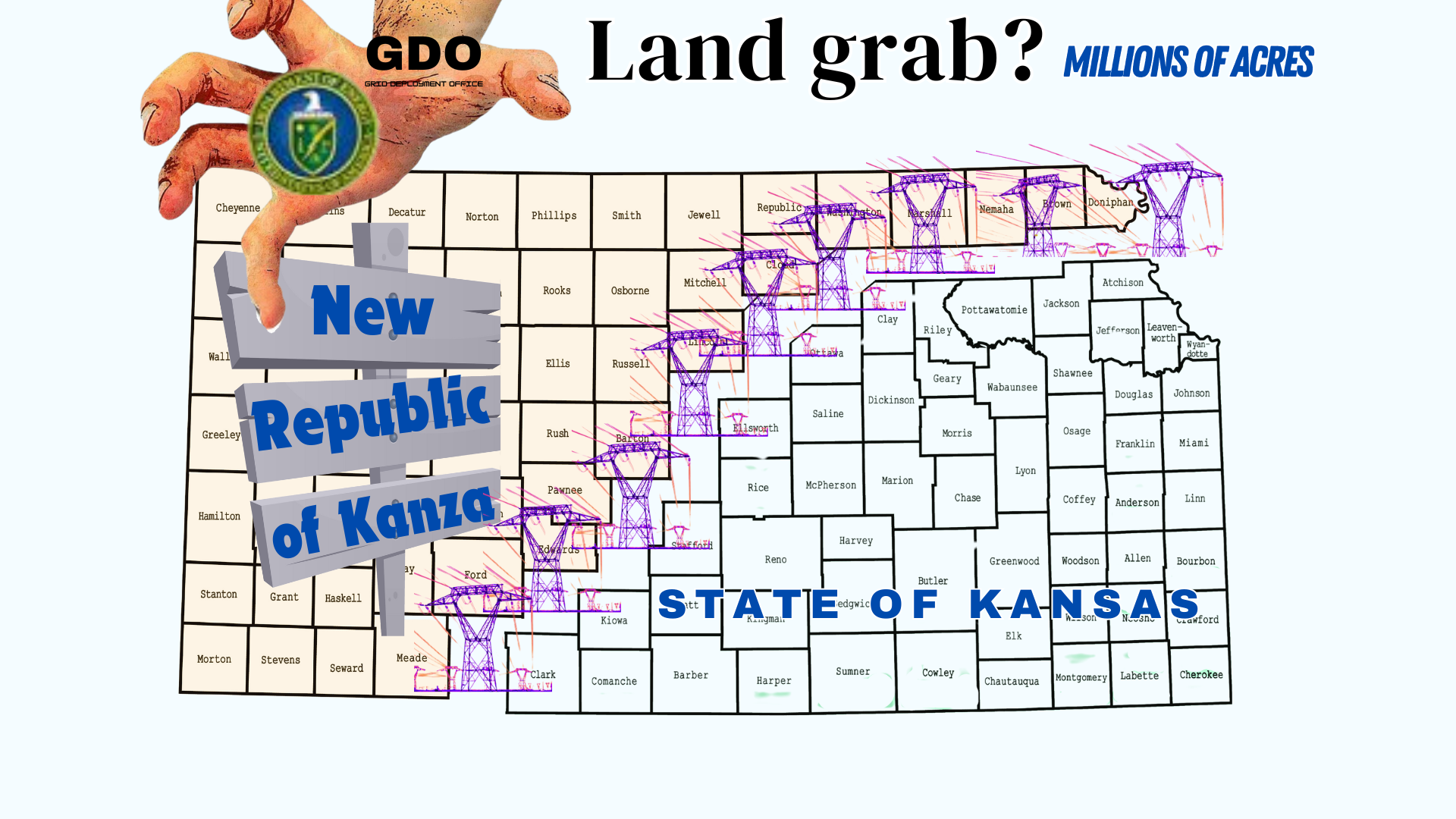

5-MILE-WIDE CORRIDOR CREATES DIVISION LINE ACROSS KANSAS

Invenergy’s Grain Belt Express Rolls Over Landowners

Joe Biden Interjects “Fast 41” Status on Transmission Line

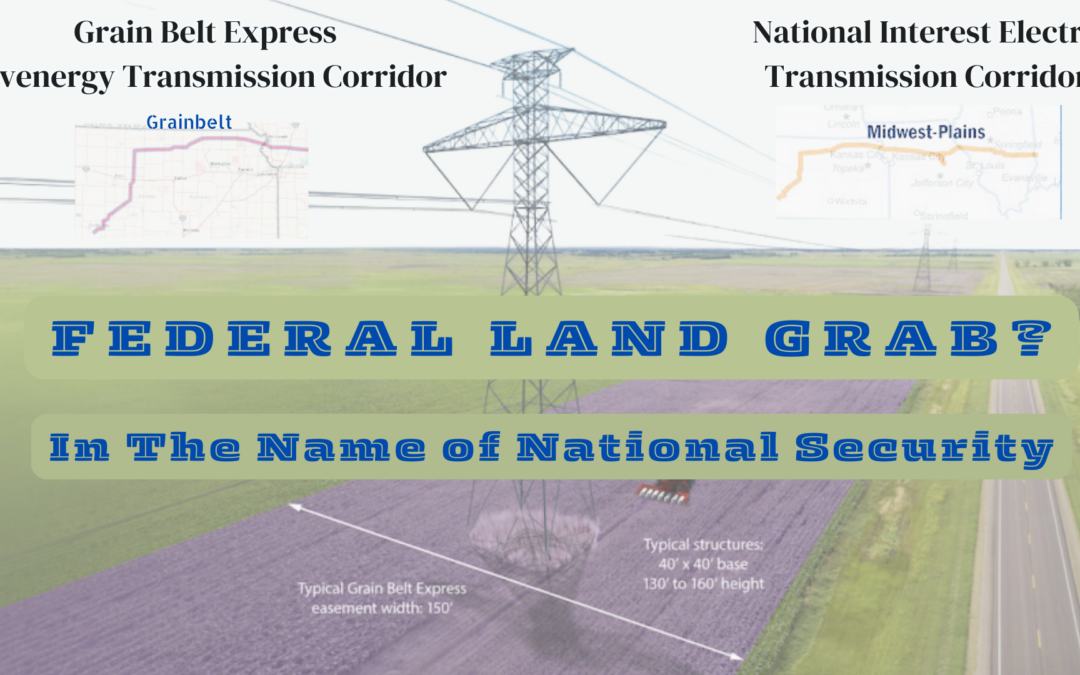

The Biden administration is looking to speed up the permitting of Invenergy’s $7 billion Grain Belt Express Electric transmission line by giving it a special designation reserved for large complex infrastructure projects.

With the designation of FAST-41, the project’s first phase will be capable of delivering up to 2,500 MW of renewable energy from southwest Kansas to northeastern Missouri. These projects will receive a comprehensive and integrated federal permitting timetable. So, how did the Grain Belt Express Project find it way from the KCC’s graveyard of dead projects to a “Fast-41” designation?

From Moth Balls To Full Steam Ahead

The 2012 transmission project, the Grain Belt Clean Line Express, never gained approval for a Transmission Siting by the Kansas Corporation Commission during 8 years of hearings. Grain Belt Clean Line Express, LLC exhausted the financial backing used to keep the project alive and in 2018 pulled the plug on the project. During the four public hearings required by the Kansas Statute, the transmission project faced opposition from thousands of Kansas landowners. Over 100 public meetings, 11,500 attendees, 56 sworn statements, 2600 written comments, 26 Newspaper opinions, and lawsuits by Counties, the Grain Belt Clean Line Express raised the white flag of surrender.

In 2019 Application for Acquisition by Invenergy Transmission LLC to purchase the Grain Belt Express Clean Line LLC, changing the name to Grain Belt Express with a new sunset of 11-23-2023. Designation of a FAST-41 Project, Financing of the Grain Belt will fall on taxpayer funding and assurance from the federal authorities the Transmission Line will be built in the name of National Security of the Electrical Grid.

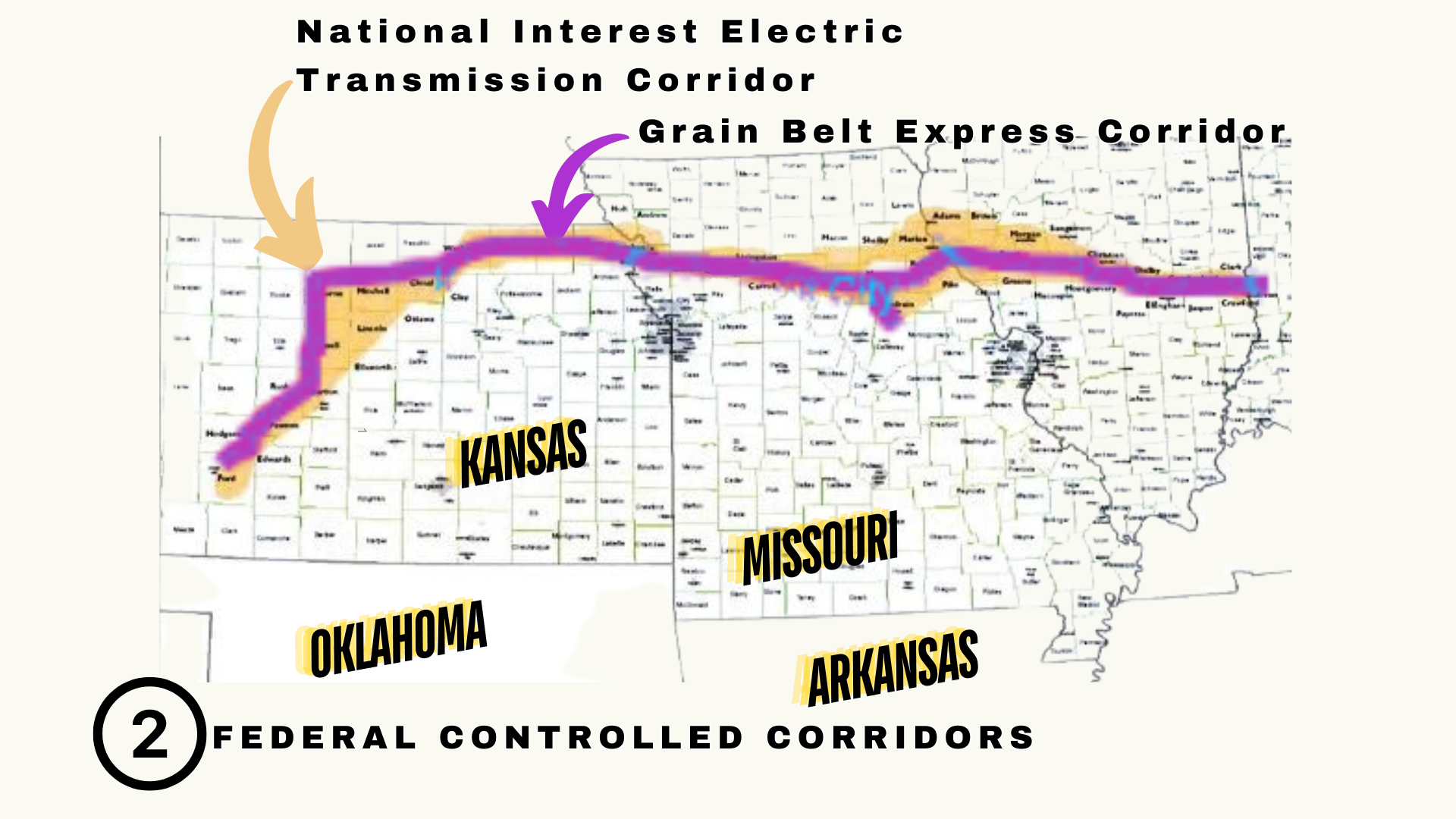

FERC Unveils 2nd Project- 5-Mile Wide NIETC Corridor

Landowners had just discovered that the Grain Belt Line was being expedited only to find out about another project heading to Kansas. Property owners in Kansas have once again found themselves at a disadvantage without notice from the Kansas Corporation Commission. The Midwest Plains Project is a 580-mile 5-mile-wide Corridor that will cross Kansas, Missouri, and Illinois for a National Interest Electric Transmission Corridor (NIETC). Again, federal fast-tracking past any public input gave little time for the facts to be exposed. The “Fast 4 Projects” process is being used to expedite projects at warp speed, neglecting the rights of property owners to be able to respond publicly.

The silence of the KCC on these Federal projects designed to accelerate the DC electric transmission infrastructure has left Counties and Property Owners at a loss. Information for “Fast 41 Projects” does not appear on the KCC Website News or in the agency’s email notices. The proposed area for the Midwest Plains Corridor would equal 1.2 million acres of Private Kansas land. Those acres will be transferred to Federal Control and much of it through eminent domain.

Senator Hawley Calls Out “huge land grab”

Is Missouri Senator Hawley correct in calling Joe Biden’s “Fast 41 Projects” nothing more than an unconstitutional Land Grab? Most Landowners on both sides of the Missouri-Kansas State Line agree. The federal government’s confiscation of private property for transmission corridors that serve no utility customer in either state amounts to an abuse of power to implement an agenda lacking a proven scientific theory. Ideology is not science nor is manufactured data to fit the narrative. What has been proven through history has been agendas such as “Zero Carbon” will cripple individual livelihoods and destroy local economies. Land is what secures every American’s Freedom as stated in the Constitution.

Stop the Madness

It is time to bring the Hammer Down on Legislators who are out campaigning. The Kansas Legislature has authority over the generation and distribution of power in Kansas. The legislative body is the Overseer of the Kansas Corporation Commission by statute. If the KCC is not acting in the best interests of Kansas citizens, is it merely functioning as an extension of the Federal government? It is time to make elected officials implement a moratorium on green energy projects, transmission lines, and carbon storage. If the authority of the KCC has become neutered by the federal government agent, the Southwest Power Pool, the legislature should put on the gloves and get ready for the fight. Ridding the KCC of less-than-honest commissioners who have become bad actors would be a great start. Pulling the purse strings of an agency that has failed to deliver for the people of Kansas would be another avenue to reign it in. Call your Kansas Senator & House member today! Request a special hearing to address the federal government’s overreach and the Kansas Corporation Commission’s failure to safeguard the rights of property owners in Kansas. It is time to return to Topeka and hear from the public.

Stay Informed, Sign-up for the Stand 4 the Land Kansas Newsletter